2026 Tax Planning

Let’s be real—nobody wakes up excited about tax season. But this year? You might actually smile when you see the new numbers. The IRS just dropped its 2026 inflation adjustments, and thanks to the One Big, Beautiful Bill (yes, that’s the actual name), there are some changes worth talking about over your morning coffee. Whether you’re a freelancer juggling side hustles, a couple trying to max out deductions, or a small business owner thinking about childcare benefits, these updates could put more money back in your pocket. Let’s break it down without the tax jargon headache. The Standard Deduction Got a Serious Upgrade. Remember when you used to claim that $12,950 standard tax planning deduction? Those days are long gone. For 2026, we’re looking at some meaningful bumps: • Married couples filing jointly: $32,200 (up from $31,500 in 2025) • Single filers: $16,100 (up from $15,750 in 2025) • Head of household: $24,150 (up from $23,625 in 2025).

Real-World Example: Meet Sarah. Sarah is a 34-year-old graphic designer in Austin. She’s single, rents an apartment, and doesn’t have enough itemized deductions to worry about. In 2025, she could deduct $15,750 right off the bat. For 2026, that jumps to $16,100. That’s an extra $350 shielded from taxes. If Sarah’s in the 22% tax bracket, that extra deduction saves her about $77 in federal taxes. Not life-changing, but that’s a decent brunch or two streaming subscriptions for the year—all because the IRS adjusted for inflation. Tax Brackets Are Shifting Too (In Your Favor).

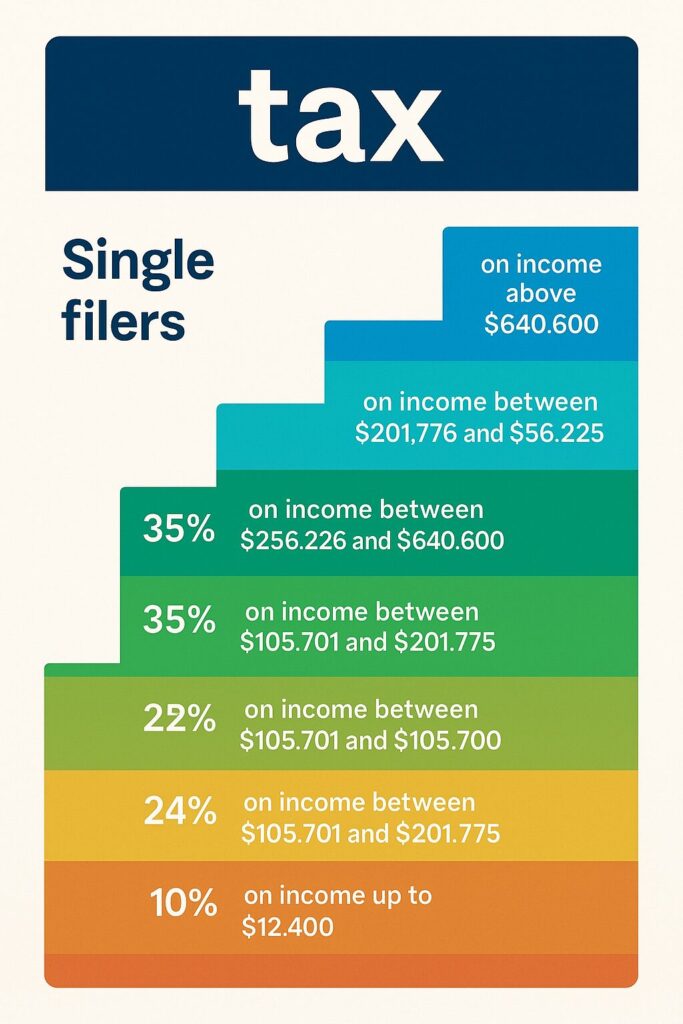

The tax brackets got wider for 2026, which means you can earn more before jumping into a higher tax rate. Here’s the breakdown for single filers:

• 10% on income up to $12,400

• 12% on income between $12,401 and $50,400

• 22% on income between $50,401 and $105,700

• 24% on income between $105,701 and $201,775

• 32% on income between $201,776 and $256,225

• 35% on income between $256,226 and $640,600

• 37% on income above $640,600

Carlos and Ana Martinez file jointly and expect to make about $250,000 combined in 2026. Under the old 2025 brackets, they’d hit the 32% bracket sooner. With the 2026 adjustments, more of their income stays in the 24% bracket before jumping up. The practical impact? They’re not being penalized as harshly by “bracket creep”—that annoying phenomenon where inflation pushes you into a higher tax bracket even though your purchasing power hasn’t really increased. Estate Tax: You Can Now Leave More to Your Kids. If you’re in the fortunate position of worrying about estate taxes, 2026 brings good news. The basic exclusion amount jumped to $15 million per person, up from $13.99 million in 2025.

Robert and Linda Chen have built a successful tech consulting business over 30 years. Their estate, including their business, property, and investments, is valued at around $28 million. In 2025, they could pass on $27.98 million tax-free as a couple ($13.99 × 2). In 2026, that increases to $30 million ($15M × 2). That means their entire estate now falls under the exclusion threshold, and their kids won’t face a massive federal estate tax bill. That extra million-dollar cushion gives families like the Chens more breathing room and less stress about triggering estate taxes.

Small Business Owners: Childcare Credit Just Got WAY Better.

Here’s where things get genuinely exciting. The employer-provided childcare tax credit was basically collecting dust at $150,000 max. The One, Big, Beautiful Bill cranked it up to $500,000 (or $600,000 for eligible small businesses).

Real-World Example: TechStart Solutions Jessica runs a 45-person software company in Denver. She’s been wanting to offer on-site childcare for her employees, but couldn’t justify the cost with only a $150,000 tax credit. With the new $600,000 small business credit, the math completely changes. She can now invest in quality childcare facilities, which: • Helps employee retention (parents don’t need to scramble for daycare) • Reduces absenteeism (no more “my sitter canceled” calls) • Makes her company more attractive to talented parents. The credit doesn’t cover 100% of her costs, but it makes the investment feasible. Jessica estimates she’ll retain at least three key employees who were considering leaving due to childcare struggles. The credit pays for itself in reduced recruitment and training costs. Other Changes That Might Affect You.

Earned Income Tax Credit (EITC) If you’re a working family with kids, the maximum EITC for three or more qualifying children increased to $8,231 (up from $8,046). It’s not a huge jump, but every bit helps. Adoption Credit: Adopting a child in 2026? You can now claim up to $17,670 in qualified expenses, with up to $5,120 being refundable. Adoption isn’t cheap, and this credit helps ease the financial burden for families growing through adoption.

Foreign Earned Income Exclusion: Digital nomads and expats, this one’s for you. If you’re living and working abroad, you can now exclude up to $132,900 of foreign income from U.S. taxes (up from $130,000). That’s an extra $2,900 that won’t be taxed. Real-World Example: Digital Nomad Dave Dave is a software developer who’s been living in Lisbon while working remotely for a U.S. company. He earns $125,000 a year. With the foreign earned income exclusion at $132,900, his entire salary falls under the exclusion threshold, meaning he pays zero federal income tax on it (though he still pays self-employment taxes). If Dave’s income had been $131,000, he would have only paid U.S. tax on the $1,000 over the 2025 limit. Now with the higher 2026 exclusion, he’s completely covered.

Not everything got adjusted: • Personal exemptions: Still zero. The Tax Cuts and Jobs Act eliminated these back in 2017, and the One, Big, Beautiful Bill made that permanent. However, there’s now a senior deduction that partially fills this gap. • Itemized deductions: No limitation for most people, which is good news. But if you’re in the top 37% tax bracket, there are now some restrictions on the tax benefit you get from itemizing. • Lifetime Learning Credit: The phase-out thresholds remain stuck at 2020 levels ($80,000-$90,000 for single filers, $160,000-$180,000 for joint filers). If you’re pursuing continuing education, these unchanged limits might affect whether you can claim the credit.

Tax law changes can feel overwhelming, but these 2026 adjustments are mostly working in your favor. Between higher standard deductions, wider tax brackets, and significantly better credits for things like childcare and adoption, there’s less tax burden across the board.

The key is knowing what’s available. Too many people miss out on credits and deductions simply because they don’t know they exist. Whether you’re a W-2 employee, a business owner, or somewhere in between, take some time to see how these changes affect your specific situation.

And hey, if math isn’t your thing (no judgment—it’s not for most of us), this might be the year to chat with a tax professional. The money you save could easily outweigh the cost of getting expert help.

Pro Tips for 2026 Tax Planning

1. Adjust your withholding: With higher brackets and deductions, you might be having too much withheld from your paycheck. Use the IRS withholding calculator to dial it in.

2. Document everything: Those new childcare credits and adoption expenses require documentation. Keep receipts, invoices, and records organized throughout the year.

3. Plan for next year: If you’re close to a bracket threshold, consider timing major income or deductions strategically.

4. Don’t forget state taxes: These federal changes don’t automatically flow to your state return. Some states conform to federal law, others don’t. Know your state’s rules.

5. Review your estate plan: If you’ve got significant assets, that higher estate tax exclusion might change your planning strategy. Talk to an estate attorney.

Final Thoughts: Tax season might never be fun, but at least 2026 brings some positive changes. The combination of inflation adjustments and the One Big, Beautiful Bill provisions means most people will see a slightly lighter tax load—or at least won’t be penalized by inflation pushing them into higher brackets. The best part? These aren’t complicated loopholes or tricks. They’re straightforward adjustments that happen automatically when you file your taxes. Just make sure you’re using the right forms, claiming the credits you’re eligible for, and taking advantage of the higher standard deduction.