Managing your company’s finances is a critical component of business success, but how do you decide between the Best Virtual CFO Services and an in-house CFO? Both options bring unique benefits, but the right choice depends on your business’s size, budget, and goals.

Virtual CFOs offer expert financial management, strategic planning, and financial forecasting without the cost of a full-time employee, making them ideal for small businesses or startups. On the other hand, an in-house CFO provides hands-on guidance and a dedicated presence for financial decisions and business growth—a perfect fit for larger, more complex organizations.

In this blog, we’ll explore the differences, benefits, and key roles each option plays in shaping your financial strategy and achieving your business objectives. By the end, you’ll have the insights needed to choose the best path for your company’s financial performance and future growth.

What Is a Virtual CFO?

A Virtual CFO (Chief Financial Officer) is a financial expert who provides businesses with high-level financial strategy, planning, and management services on a flexible basis. Unlike a full-time CFO, a virtual CFO works remotely and is often engaged part-time or on specific projects, making it a cost-effective solution for startups, small businesses, and growing companies.

They assist with financial reporting, cash flow management, business forecasting, and strategic decision-making. Virtual CFOs bring extensive expertise and real-time insights, helping business owners achieve their financial goals, improve performance, and navigate complex challenges without the expense of hiring a full-time executive.

What Does an In-House, Full-Time CFO Offer?

An in-house CFO is a full-time employee who works directly for your company. This role requires a commitment of time, money, and resources. A full-time CFO typically handles a wide range of responsibilities, including financial reporting, strategic planning, and managing the financial team. They’re involved in business decisions and ensure your financial management aligns with your business goals and business strategy.

In-house CFOs provide personalized financial services tailored to the company’s specific needs, and they often play a critical role in financial decisions, financial analysis, and financial forecasting. For large companies or businesses with complex needs, this approach may offer the depth of financial guidance required for long-term growth.

The Benefits of Best Virtual CFO Services

Cost-Effectiveness:

Hiring a full-time CFO can be expensive, with salaries for in-house CFOs often reaching into the six-figure range. In contrast, Best Virtual CFO Services offer flexibility and scalability without the high costs. You only pay for the specific financial services you need, like cash flow management, tax planning, or strategic advice. This is especially beneficial for smaller businesses or those just starting up.

Flexible Service Levels:

One of the biggest advantages of a virtual CFO is the ability to scale services to meet your needs. Whether you require financial reviews on a monthly basis, strategic planning for business forecasting, or consulting services for eCommerce businesses, you can customize your package based on the stage and level of growth of your business. Virtual CFO services are adaptable to a wide range of business requirements, from project basis to long-term advisory services.

Focused Financial Expertise:

When you hire a single virtual CFO, you’re gaining the expertise of an experienced financial professional who works directly with your company. Unlike larger teams, a virtual CFO provides you with personalized financial advice tailored specifically to your needs. They manage your financial strategy, cash flow management, financial reporting, and all other essential financial operations, ensuring that your business is financially sound and aligned with its goals. Their one-on-one attention means that they become familiar with your business inside and out, providing better guidance on strategic decision-making and financial performance.

Strategic Advice and Decision-Making Support:

A virtual CFO can be a key player in strategic decision-making. They provide valuable insights that help you make informed business decisions related to cash flow, revenue streams, tax services, and more. With their extensive industry knowledge and expertise in financial analysis, virtual CFOs offer actionable board reporting that helps you understand key metrics like key performance indicators (KPIs) and benchmark metrics.

Real-Time Insights and Financial Forecasting:

A virtual CFO can give you real-time business insights and dynamic forecasting to help you stay on top of changing financial conditions. Whether you need to manage cash reserves, optimize cash flow, or plan for future business growth, they provide forecasting models and financial models to guide your business toward success.

Customized Financial Guidance:

Unlike a full-time, in-house CFO who may be distracted by a broad array of internal company issues, a single virtual CFO focuses on your company’s specific needs. Whether it’s financial forecasting, tax planning, or strategic advice, your virtual CFO tailors their services to your company’s unique financial situation. This focused attention ensures your business receives the financial guidance necessary to make well-informed financial decisions and meet business goals without any distractions.

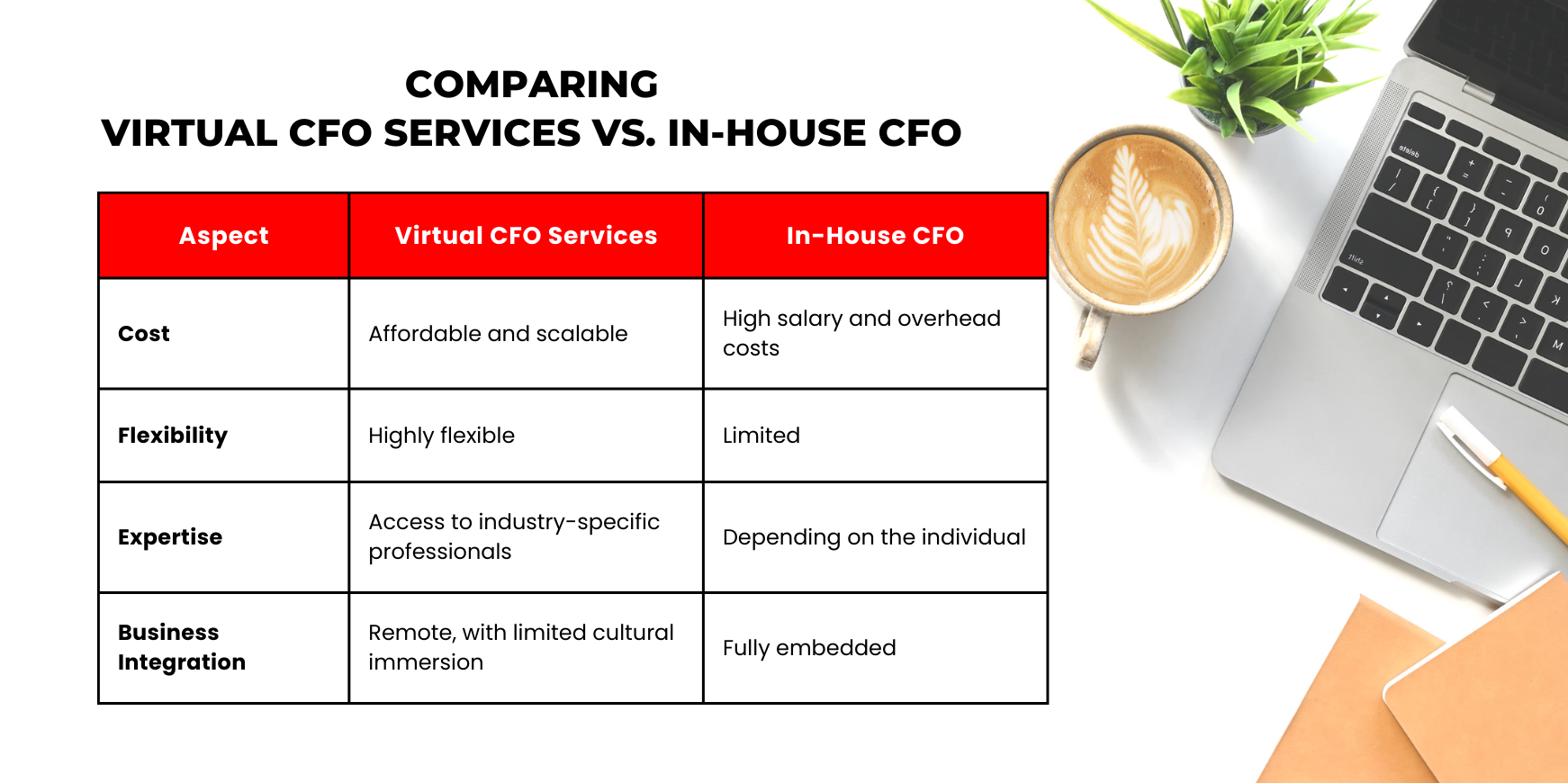

Comparing Virtual CFO Services vs. In-House CFO

Why Choose an In-House CFO?

While a virtual CFO offers many benefits, there are certain scenarios where a full-time CFO might be the better option. If your company is large, complex, or rapidly expanding, you might require a full-time executive who can dedicate their time exclusively to managing your finances, financial planning, and strategic cash flow management.

An in-house CFO can also be more involved in daily operations, offering hands-on support and guidance for the internal team. They’ll be present for impromptu meetings, contribute to accounting services, and help develop long-term financial strategies aligned with your business objectives.

Top 5 Best Virtual CFO Companies in the USA

As businesses strive to maintain a competitive edge, having a skilled CFO becomes crucial. However, not every company can afford a full-time CFO. This is where virtual CFO services step in, offering expertise at a fraction of the cost. Here are the top 5 companies that provide the best virtual CFO services, with Intellgus leading the way.

1. Intellgus: Empowering Your Financial Growth

Intellgus has redefined how businesses access CFO expertise by offering highly tailored and flexible virtual CFO services. Known for its exceptional track record in helping businesses streamline finances, Intellgus stands out as a trusted partner for small businesses and startups alike.

Why Choose Intellgus?

- Cost-effective and scalable CFO services for small businesses.

- Access to the top 5% of CFO professionals

- Advanced financial forecasting and budget management.

- Proactive solutions to improve cash flow and profitability.

- 24/7 support from experienced financial professionals.

Whether you’re looking to hire virtual CFO services or need guidance in managing your financial strategies, Intellgus offers unmatched expertise and personalized solutions.

2. CFO Bridge

CFO Bridge is known for providing elite financial professionals, including virtual CFOs. Their rigorous screening process ensures you get top-tier talent to handle your business’s financial needs.

Key Features:

- Access to top CFO professionals globally.

- Expertise in financial modeling and growth strategies.

- Custom solutions for startups and established businesses.

CFO Bridge is a go-to option for businesses seeking premium virtual CFO support.

3. Kruze Consulting

Specializing in startups, Kruze Consulting offers virtual CFO services that cater to early-stage businesses and growing companies. Their services focus on compliance, tax, and financial planning.

Key Features:

- CFO services are designed specifically for tech startups.

- Comprehensive tax planning and compliance assistance.

- Advanced financial dashboards for real-time reporting.

Kruze is perfect for businesses looking for growth-oriented CFO services tailored to modern industries.

4. B2B CFO

B2B CFO Solutions is a popular choice for B2B businesses seeking financial expertise. They offer virtual CFO services designed to handle budgeting, forecasting, and strategic financial advice.

Key Features:

- Highly vetted and experienced virtual CFOs.

- Monthly financial reporting and analysis.

- Focused on B2B businesses.

B2B CFO flexibility and affordability make them an ideal partner for companies needing part-time financial leadership.

5. CFO Selections

CFO Selections integrates technology with virtual CFO services, providing small businesses with automated tools and expert guidance. Their software-driven approach makes financial management easier and more efficient.

Key Features:

- Combines software automation with expert CFO insights.

- Real-time financial visibility for better decision-making.

- Customized solutions for various industries.

CFO Selections’ innovative blend of technology and expertise is a game-changer for modern businesses.

Which Option Is Right for Your Business?

Choosing between the Best Virtual CFO Services and a full-time CFO ultimately depends on your business’s financial needs, budget, and growth stage. If you’re a small or midsize business looking to reduce costs while getting high-quality financial advice, a virtual CFO could be the ideal solution. On the other hand, if you’re managing a larger company with complex financial needs and want a hands-on approach, a full-time CFO might be the better choice.

For startups or businesses with limited resources, virtual CFO services provide the flexibility and expertise you need without the burden of hiring a full-time employee. They can help you make strategic decisions, manage cash flow issues, and ensure your business stays on track toward meeting its financial goals.

Final Thoughts: A Tailored Financial Strategy

Both virtual CFO services and in-house CFOs offer unique benefits. The key is to assess your business’s financial needs, goals, and resources.

If you’re looking for cost-effective, flexible, and expert-driven financial management, virtual CFO services are an excellent choice. However, if your business requires someone deeply integrated into daily operations, an in-house CFO might be the better option.

Remember, the best decision is one that aligns with your business’s growth strategy and long-term goals.

Take Control of Your Financial Future with Intellgus!

Struggling to decide between a virtual CFO and an in-house hire? At Intellgus, we empower business owners with tailored financial solutions designed for growth. Whether it’s strategic planning, cash flow management, or forecasting, our Virtual CFO services deliver expertise without the hefty price tag. Let us help you make smarter decisions and focus on what matters most—scaling your business.

📈 Ready to redefine your financial strategy? Contact Intellgus today and unlock the path to success. Schedule a free consultation now!